The Finance Ghost

- 3 min read

Investing In A Mad Scientist

Well, it’s that time of year again. Nadella, Zuckerberg and several other incredibly wealthy executives have cracked open the corporate treasure chests and allowed us to look inside. Welcome to another quarterly results season in the US market, where tech companies continue to struggle as their valuation multiples look increasingly unjustifiable.

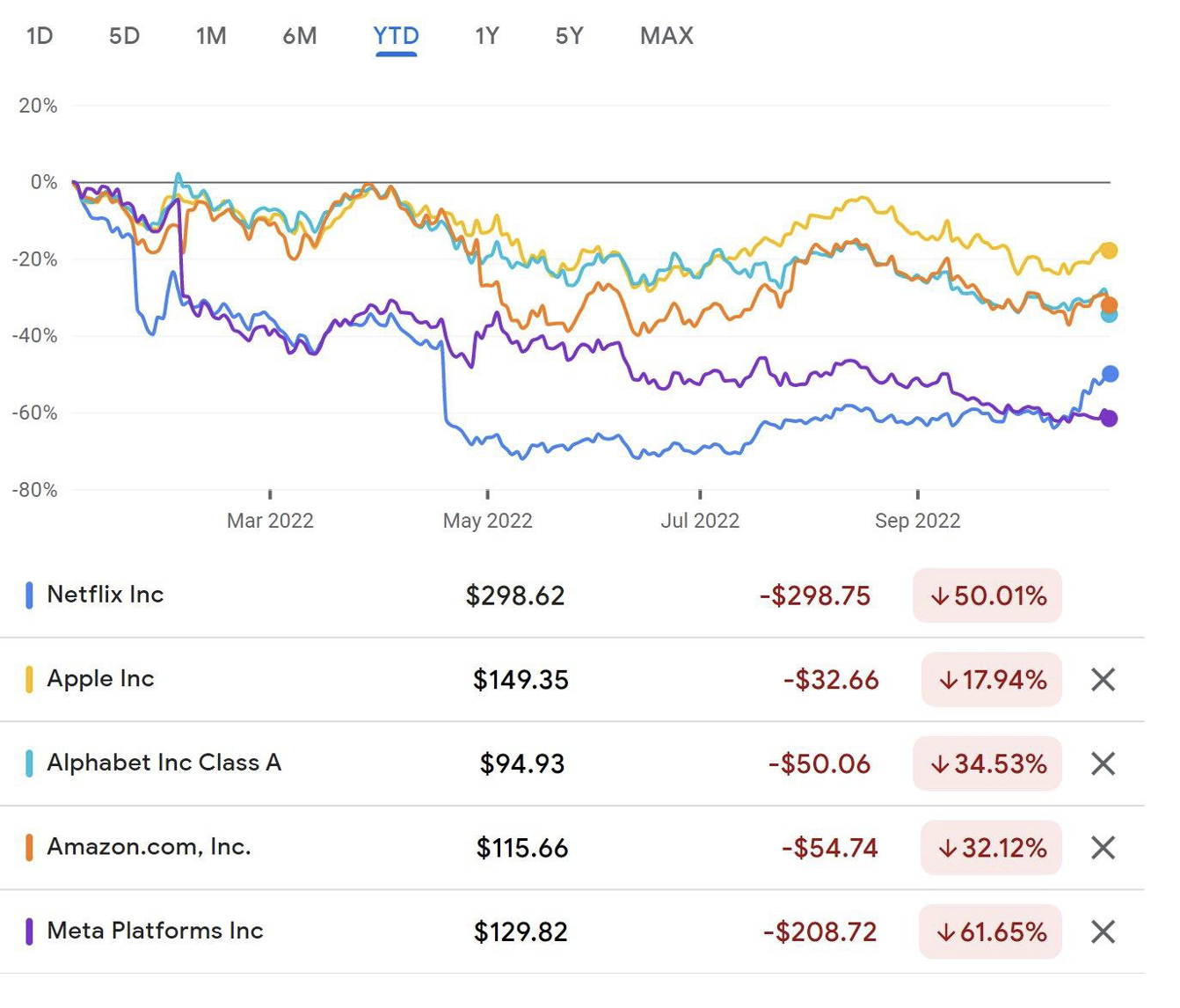

The year-to-date performance of the FAANG stocks (a now terribly outdated acronym) has been truly awful. It seems most appropriate to use Google Finance for this chart:

In case you’re wondering, other big names like Microsoft (-31%) and NVIDIA (-57%) haven’t been spared. In fact, Hewlett Packard Enterprise deserves an honourable mention for only being down 13%!

The worst card in the FAANG pack is Meta Platforms (previously Facebook), and the joker is certainly Zuckerberg. We may as well focus our attention there.

Zuckerberg Doesn’t Use The Brake Pedal

Does anyone still use Facebook?

Well, yes they do - 1.98 billion daily active users are still on the platform! Take it with a pinch of salt at the next barbecue when the topic is how Facebook is dying.

What is dying is the frequency of posting by users. Meta doesn’t explicitly say this, so such an observation is based purely on my timeline that is filled with “funny third-party videos” rather than holiday photos from friends. Whether or not this is a bad thing is a separate debate.

What we do know is that Meta is focusing on delivering popular content from influencers, rather than more boring photos of Aunt Marjorie’s Yorkshire Terrier that only your mother feels compelled to like or comment on. Much of the content is in Reels rather than Newsfeed, which means Facebook users are scrolling left to right these days rather than top to bottom. That makes a big difference, as Facebook’s historical strength has been in delivering ads in Newsfeed.

TikTok changed the game for social media. Facebook in particular has been affected by this focus on short videos. Instagram (also owned by Meta) is in better shape, as the platform has always been about images and videos rather than posts by people ranting about the state of potholes on certain roads. Still, there’s pressure across the Meta ecosystem.

With a spectacular 20% collapse in the Meta share price in after-hours trading as a response to the latest earnings, Meta’s year-to-date performance is now worse than anything the Scuderia Ferrari strategists have dished up. With 70% of the market cap wiped off the table, it’s been a shocker.

In case you haven’t been following the Meta story very closely, the share price drop has little to do with Facebook’s prospects or the threat of TikTok. Instead, it is because Zuckerberg appears to be intent on building the Metaverse at any cost. At a time when revenue is down 4% year-on-year, expenses have increased by 19%.

The situation is even worse when we look at free cash flow. With revenue of $27.7 billion and expenses of $22 billion, there’s only $5.7 billion or so in cash profits before capital expenditure. This didn’t stop Zuck & Co, with capital expenditure this quarter of over $9.5 billion.

I can’t decide whether it’s a good or bad thing that Meta’s cash balance is nearly $42 billion. The good news is that it gives Zuckerberg enough ammo to invest heavily in the Metaverse. That’s also the bad news.

Formally known as the Reality Labs division, Meta is planning to accelerate its investment in these initiatives rather than slow them down. This is no longer an investment thesis based on Reality Labs as optionality alongside the steady Family of Apps business.

No. If you’re buying Meta now, the investment thesis is Reality Labs.

A Mad Scientist

The strategy at Meta has scared off many investors, and it seems that another cohort has headed for the exit. Of course, investment wisdom tells us to buy when there is fear in the air. The trouble is that nobody is quite sure where the bottom is for Meta or just how far Zuckerberg is willing to go in his pursuit of this project.

Investing in a mad scientist is no joke. Just ask Tesla shareholders, who are down nearly 44% this year...

Share Link